44+ married filing separately mortgage interest

That includes all of your state and local income or sales tax and your real estate. Ad Check Todays Mortgage Rates at Top-Rated Lenders.

Banking Notes With Digests From Kriz P Cha Mendoza Pdf Foreclosure Loans

Web If you and your spouse file separate returns and one of you itemizes deductions the other spouse must also itemize because in this case the standard.

. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Check How Much Home Loan You Can Afford. Compare Apply Directly Online.

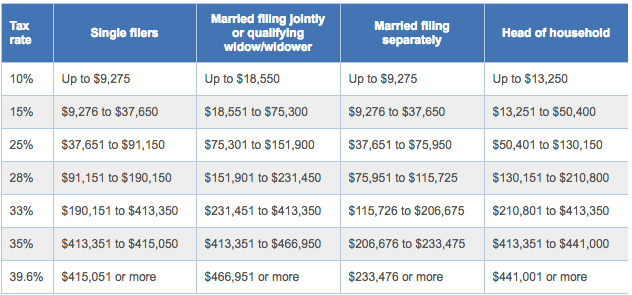

If your total itemized deductions are less than the standard you. Married filing jointly or qualifying widower 25100. Ad Compare Loans Calculate Payments - All Online.

Ad 10 Best Home Loan Lenders Compared Reviewed. Web Married filing jointly. There is no specific mortgage interest deduction unmarried couples can take.

Web Single or married filing separately 12550. Web The mortgage must be a secured debt on a qualified home in which you have an ownership interest. Head of household 18800.

You or your spouse if filing jointly must have taken out the loan. Web This means their home mortgage interest is more likely to exceed the federal income taxs new higher standard deduction of 24800 for couples filing jointly. Ad Calculate Your Payment with 0 Down.

Web If you are married and filing separately both you and your spouse can each deduct the interest you pay on 500000 worth of a mortgage loan. If the total amount of all mortgages is more than the fair market value FMV. A general rule of thumb is the person paying the expense gets to take the.

The limit is 500000 if married filing separately. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Web million at any time during 2022.

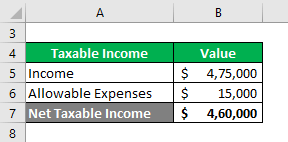

Web When you file married filing separately the cap for total state and local taxes is 5000. Comparisons Trusted by 55000000. Web Pay As You Earn Monthly Payment 10 of Discretionary Income Divided by 12 60446.

Now lets say that you owe 60000 and your spouse owes 40000 in federal student. Get Instantly Matched With Your Ideal Mortgage Lender. Lock Your Rate Today.

We Re Abandoning Pslf Biglaw Investor

The Marriage Tax Penalty Post Tcja

Progressive Tax Example And Graphs Of Progressive Tax

Prawfsblawg Property

Calameo Wallstreetjournal 20170815 The Wall Street Journal

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Phan Tich Trong Big Data Pdf

Irs Increases Marriage Penalty Unmarried Cohabitants To Get Twice The Mortgage Interest Deduction

Phan Tich Trong Big Data Pdf

Solved Basic Standard Deduction Amounts Filing Status 2018 Chegg Com

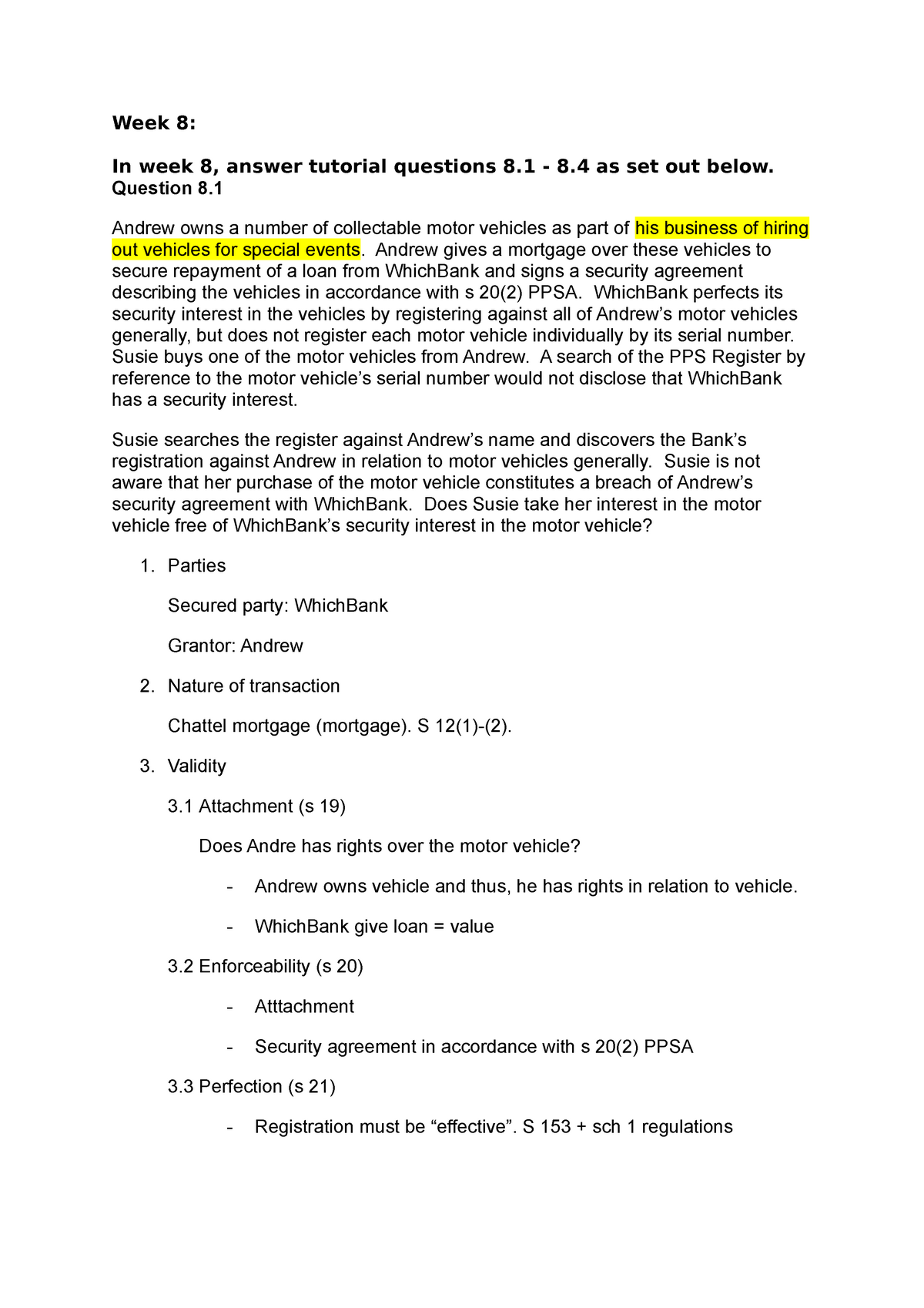

Week 8 Tutorial Week 8 In Week 8 Answer Tutorial Questions 8 8 As Set Out Below Question 8 Studocu

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Tax Deduction What You Need To Know

How To Deduct Home Mortgage Interest When Filing Separately

How Do I Calculate Tax Savings On Mortgage Interest

Irs Increases Marriage Penalty Unmarried Cohabitants To Get Twice The Mortgage Interest Deduction

Replying To Williamvalencia665 No One Tell This Guy Always A Butthur Tiktok